Iryna Kalnytska took part in the International Bar Association conference

Tags

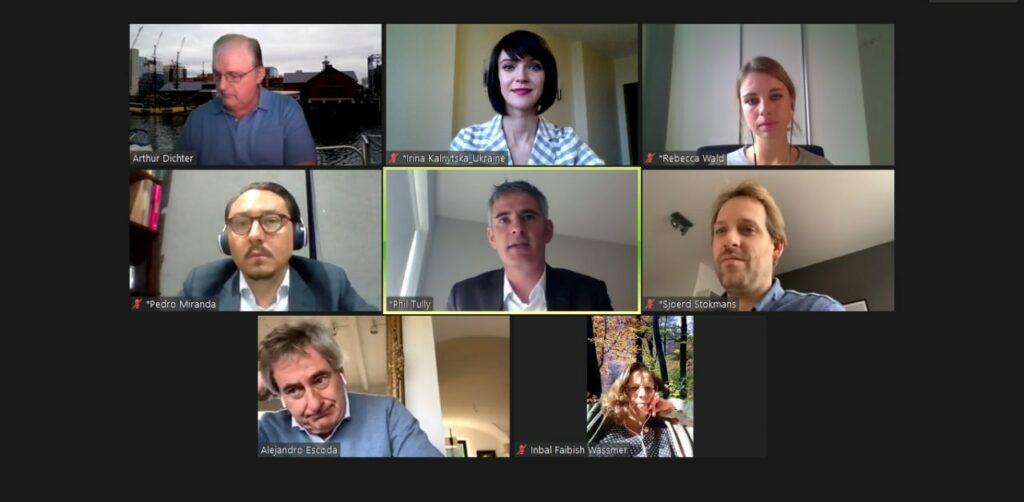

On November 13, GOLAW Partner, Attorney at law Iryna Kalnytska took part in Roundtable discussion of global trends, organized by the International Bar Association – the largest association of legal practitioners the International Bar Association. The event was a part of online conference Virtually Together, which this year was held instead of annual general conference. Iryna is a National Reporter from Ukraine of the IBA’s Taxes Committee.

The topic of the discussion was comparative Mandatory Reporting Regimes-DAC6, US reportable transactions and other trends of international taxation on the national and international levels. With the tax advisors from Germany, the Netherlands, Ireland and Mexico Iryna discussed how the mandatory disclosure regime works in practice, what transactions are reportable and what are the the fines for non-compliance with these rules. Iryna also described the latest initiatives of international taxation in Ukraine, especially implementation of the BEPS reforms.

Sign up to be aware

New achievements are inspired by information. GO further, don’t miss out GOLAW news and legal alerts

Our expertise

-

- Energy and Natural Resources

- Antitrust and Competition

- Banking and Finance

- Compliance, Corporate Governance and Risk Management

- Corporate and M&A

- Criminal and White Collar Defence

- Defense in Anti-corruption procedures and regulations

- Private: Digital Economy Practice

- Labor and Employment

- Natural Resources and Environment

- Government Relations (GR)

- Insolvency and Corporate Recovery

- Intellectual property

- International trade

- Legal support of business and private Сlients in Germany

- Litigation and dispute resolution

- Private clients

- Real Estate and Construction

- Restructuring, Claims and Recoveries

- Martial Law

- Tax and Customs

-

- Agribusiness

- Aviation

- Chemical industry

- Engineering, Construction and Building Materials

- Environment and Natural Resources

- Financial institutions

- IT and AI

- Industry and manufacturing

- Healthcare industries, Life sciences and Pharmaceuticals

- Media, Entertainment, Sports and Gambling

- Retail, FMCG and E-Commerce

- Transport and Logistics

We use cookies to improve performance of our website and your user experience.

Cookies policy

Cookies settings