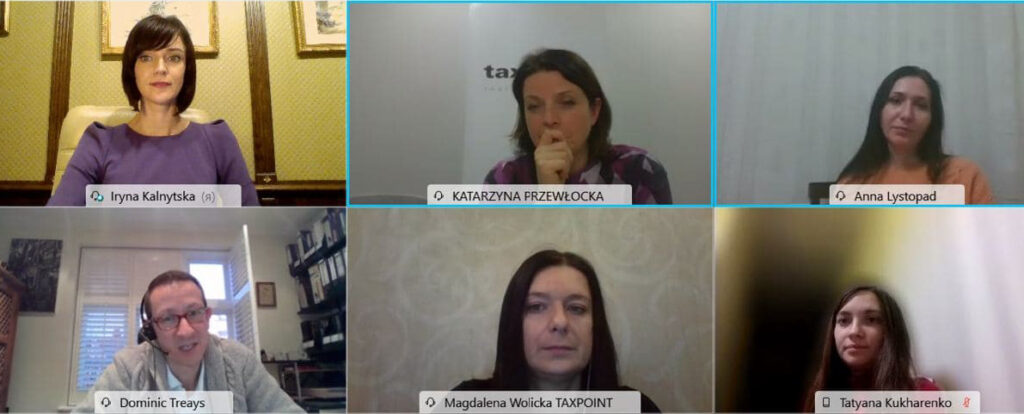

GOLAW Partner Iryna Kalnytska spoke at the ‘11th annual international taxation in CEE’ conference

Tags

GOLAW partner Iryna Kalnytska spoke at the ‘11th Annual International Taxation in CEE’ online conference which took place on December, 3-4. The event was devoted to the discussion of recent changes in tax planning, mandatory disclosure rules,, managing tax audits, tax risks, transfer pricing guidelines and case studies on tax compliance in Central and Eastern Europe.

Iryna delivered the presentation on ‘Ukrainian Tax Reform 2020: BEPS implementation in Ukraine’. The speaker focused on the recently adopted in Ukraine Law No. 466, which aims to implement the main measures under the BEPS Project, and its consequences for foreign businesses operating in Ukraine.

In particular, Iryna paid attention to the new rules of taxation for non-residents, which made the presence of the latter in Ukraine much more difficult without a permanent establishment. Thus, among the сhanges the non-residents should already take into account – a) from July 1, 2021, tax audits of non-residents conducting their commercial activities through permanent establishments in Ukraine will be allowed for carrying out; b) by January 1, 2021, non-residents operating in Ukraine, including through permanent establishments, are obliged to register in Ukrainian tax authorities.

Iryna also discussed the changes in application of Double Tax Treaties and introduction of the “principal purpose” test.

In certain cases, a taxpayer will have to prove that the principal purpose of a transaction is not tax evasion, otherwise, the company will have to pay the 15% WHT

the speaker commented

The event was organized by TMF Group.

Please click bellow to download Iryna’s presentation form the conference.

Related insights

19 February 2026 Legal news

Attorney at GOLAW Tetiana Opanasiuk spoke at an international conference on Ukra...

13 February 2026 Legal news

Screening of foreign direct investment: the temporary interdepartmental commissi...

27 January 2026 Legal news

The Status of Critically Important Enterprise in 2026: Changes to the Minimum Wa...

Sign up to be aware

New achievements are inspired by information. GO further, don’t miss out GOLAW news and legal alerts

Our expertise

-

- Energy and Natural Resources

- Antitrust and Competition

- Banking and Finance

- Compliance, Corporate Governance and Risk Management

- Corporate and M&A

- Criminal and White Collar Defence

- Defense in Anti-corruption procedures and regulations

- Digital Economy Practice

- Labor and Employment

- Natural Resources and Environment

- Government Relations (GR)

- Insolvency and Corporate Recovery

- Intellectual property

- International trade

- Legal support of business and private Сlients in Germany

- Litigation and dispute resolution

- Private clients

- Real Estate and Construction

- Restructuring, Claims and Recoveries

- Martial Law

- Tax and Customs

-

- Agribusiness

- Aviation

- Chemical industry

- Engineering, Construction and Building Materials

- Environment and Natural Resources

- Financial institutions

- IT and AI

- Industry and manufacturing

- Healthcare industries, Life sciences and Pharmaceuticals

- Media, Entertainment, Sports and Gambling

- Retail, FMCG and E-Commerce

- Transport and Logistics

We use cookies to improve performance of our website and your user experience.

Cookies policy

Cookies settings