Public-private partnerships (PPP) should be used to rebuild Ukraine

After our victory, rebuilding Ukraine’s infrastructure will be one of the key challenges for the country, as it will require significant investments. The experience of other countries shows that public-private partnerships can be an effective way to attract private sector capital.

A unique opportunity

As a reminder, according to the the Law of Ukraine “On Public-Private Partnership, the essence of cooperation between the state and business is to create or build (including reconstruction, restoration, overhaul, technical re-equipment) a certain facility and then manage it in the long term (5 to 50 years). In this case, the private partner makes investments in the facility and bears some of the risks in the course of the contract.

Unlike other ways of raising funds, such a partnership allows an investor to make a profit over a long period of time. By investing once, they can expect a much higher return than if they were to lend money. Moreover, partnerships offer businesses a unique opportunity to access the market for public sector goods and services. These include, for example, the production, transportation and supply of heat, distribution and supply of natural gas, construction or operation of roads, railways, subways, seaports and river ports and their infrastructure, mechanical engineering, water collection, treatment and distribution, healthcare, etc.

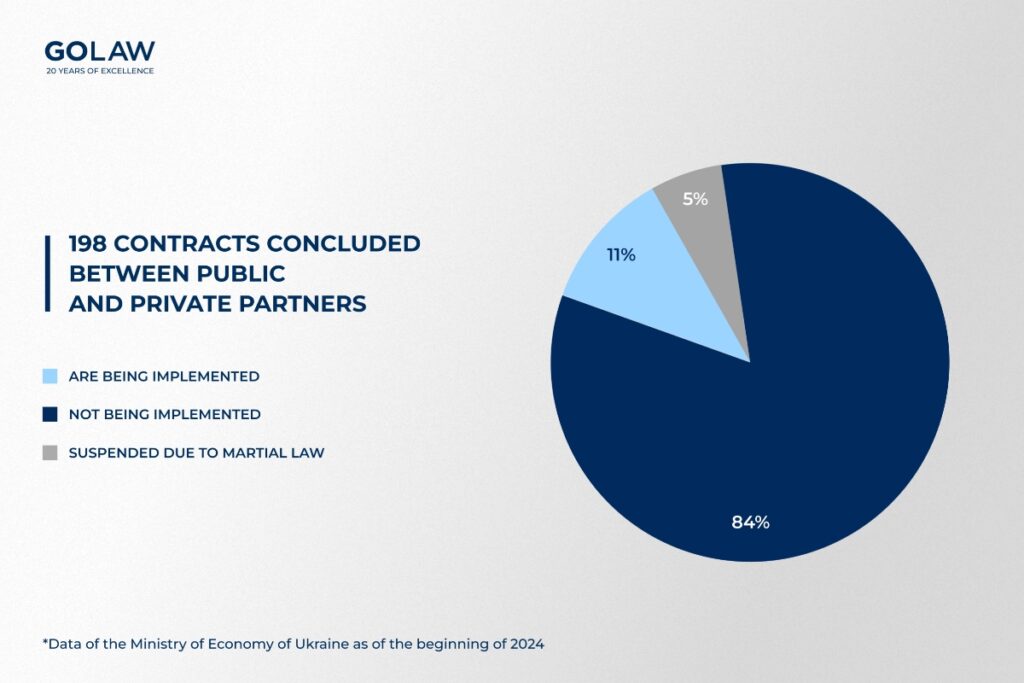

Today, the level of investment needed to rebuild the country is estimated at about $500 billion. However, the mechanism of public-private partnerships in Ukraine does not work properly. Thus, according to the Ministry of Economy, as of the beginning of 2024, 198 partnership agreements were concluded in Ukraine. Of these, only 22 (11%) are being implemented. 166 projects (84%) are not being implemented for various reasons, and 10 agreements (5%) were suspended due to the introduction of martial law. For comparison, in Germany, 11 contracts were signed in 2023 alone, under which the state attracted €4 billion in funds from private investors. Why do private partners not show significant interest in investing in our country?

Risks of participation

Part of the failure of partnerships can be explained by the complicated and time-consuming procedure for businesses to start cooperation with the state. For example, to initiate the process, a partnership proposal must be prepared, including a feasibility study and sometimes a concept note. On the basis of these documents, the authorized body analyzes the prospects for effective cooperation and makes a decision on partnership. Under any circumstances, this issue must be resolved within three calendar months from the date of submission of the proposals.

After that, a tender committee is formed, the facility is prepared for transfer to the private partner, advisors are engaged, etc. The deadline for this is six months after the decision to partner is made. Only then is an agreement between the private and public partners concluded. In practice, the procedure can take up to 2 years.

The level of interest in cooperation is also significantly affected by corruption risks, lack of transparency and clearly defined guarantees for the private partner.

In view of this, high-quality, investor-oriented regulation is essential for improving the state of public-private partnerships. And Ukraine is taking some steps in this direction.

Prospects for improvement

A group of MPs submitted to the Verkhovna Rada Draft Law No. 7508 “On Amendments to Certain Legislative Acts of Ukraine on Improving the Mechanism for Attracting Private Investment Using the Mechanism of Public-Private Partnership to Accelerate the Restoration of War-Damaged Facilities and the Construction of New Facilities Related to the Post-War Restructuring of the Ukrainian Economy.” In October 2022, it was adopted as a basis, but unfortunately, the document is not moving forward.

The project aims to reform the mechanism for attracting investment. Among the positive developments are the following:

- introduction of an electronic trading system for projects and an electronic platform for project preparation and management;

- expanding the list of objects of public-private partnership;

- the possibility of unilateral termination of the agreement by the private partner in case of failure to conclude an agreement on delegation of functions of the construction customer within one year from the date of the agreement conclusion – for partnership projects where the object is a public road;

- the obligation to conclude an agreement on non-disclosure of confidential information at the negotiation stage prior to the day of submission of the proposal, in case of exchange of information that is defined as confidential by one of the parties;

- simplifying and accelerating the process of launching projects with an expected value of less than EUR 5.382 million (the decision will be made based on the analysis of the concept note, without preparing a feasibility study);

- reducing the timeframe for implementing partnership activities to three months;

- autonomy of will in choosing the law that will govern the financing agreement;

- state support, which may be provided, inter alia, in the form of a guarantee of payments to the private partner, calculated to compensate for the difference between the minimum guaranteed level and the actual level of demand for goods (works, services), the production (performance and provision) of which is expected to be ensured as a result of the project.

Conclusions

Therefore, the draft law contains positive developments that will increase the interest of private partners and remove obstacles to raising funds for infrastructure reconstruction. Particularly noteworthy is that the changes are aimed at increasing the transparency of the procedure, speeding up the process of formalizing public-private partnerships, and protecting investors’ interests. This can change the system as a whole, which will become a real platform for business.

If you need legal advice, please fill out the form below to request it.

Authors:

Oleksandr Melnyk

Partner, Head of Corporate and M&A Practice at GOLAW, Attorney at Law

Yevgeniy Agashkov

Associate of Corporate and M&A Practice at GOLAW

Oleksandr Melnyk

Partner, Head of Corporate Law and M&A practice, Attorney at law

- Contacts

- 31/33 Kniaziv Ostrozkykh St, Zorianyi Business Center, Kyiv, Ukraine, 01010

- o.melnyk@golaw.ua

- +38 044 581 1220

- Recognitions

- Lexology Index: Client Choice 2026

- The Legal 500 2025

- IFLR1000 2025 (International Financial Law Review)

- Legal 500 Green Guide 2024

- 50 Leading Law Firms Ukraine 2026

Sign up to be aware

New achievements are inspired by information. GO further, don’t miss out GOLAW news and legal alerts

Our expertise

-

- Energy and Natural Resources

- Antitrust and Competition

- Banking and Finance

- Compliance, Corporate Governance and Risk Management

- Corporate and M&A

- Criminal and White Collar Defence

- Defense in Anti-corruption procedures and regulations

- Digital Economy Practice

- Labor and Employment

- Natural Resources and Environment

- Government Relations (GR)

- Insolvency and Corporate Recovery

- Intellectual property

- International trade

- Legal support of business and private Сlients in Germany

- Litigation and dispute resolution

- Private clients

- Real Estate and Construction

- Restructuring, Claims and Recoveries

- Martial Law

- Tax and Customs

-

- Agribusiness

- Aviation

- Chemical industry

- Engineering, Construction and Building Materials

- Environment and Natural Resources

- Financial institutions

- IT and AI

- Industry and manufacturing

- Healthcare industries, Life sciences and Pharmaceuticals

- Media, Entertainment, Sports and Gambling

- Retail, FMCG and E-Commerce

- Transport and Logistics

We use cookies to improve performance of our website and your user experience.

Cookies policy

Cookies settings